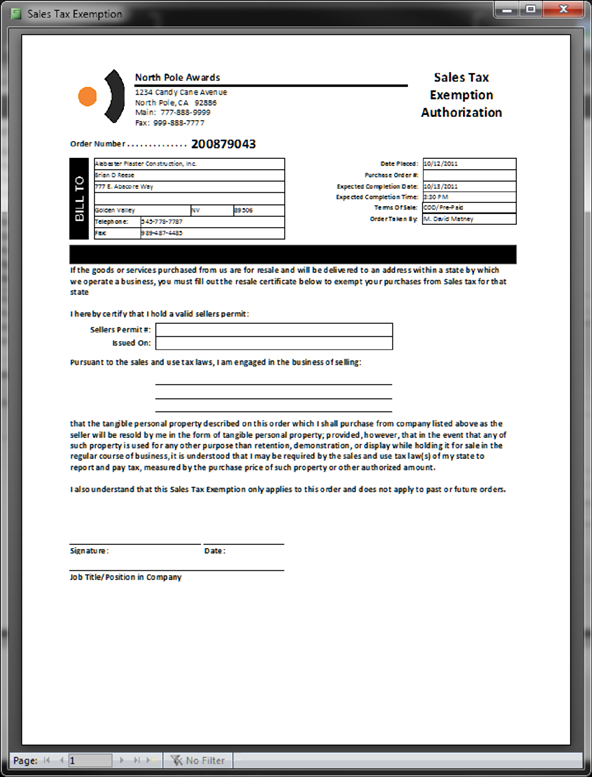

Sales Tax Exemption Request

A lot of awards stores keep a Sales Tax exemption on file for a particular company, and they simply always exempt an order from that company from Sales Tax as a result. What they may not know is that most state requirements require documentation on each order that a particular order was exempted.

For instance, if Joe Smith from ABC Corporation comes to your store and orders 10 plaques and they are reselling those plaques to XYZ Company, they would be reseller exempted. However, Joe Smith may also order 2 acrylic awards they are handing out to their employees. That order would not be Sales Tax exempt because their own company is the consumer. If you are blindly exempting each order simply because they have a reseller certificate on file and you are audited by your tax board you may find yourself with some hefty fines.

The Sales Tax exemption request is a printout on an order by order basis that requires the customer to sign and indicate to you that this particular order is indeed exempt. By requiring your customer to do this on an order by order basis, you protect your company from violating sales and use tax laws and it puts the liability back on your customer that if the customer lied about it being exempt, they will be paying the fines not you. It is a good idea to get a signature on each order vs. using the exemption number on file method. Of course the choice is yours. But this explains why this report is on an order by order basis, vs. a customer as a whole basis.

|

|