Setup

one or more sales tax schedules based on postal code region. Duplicate

postal code ranges will use the last range that includes the postal code. The system is only designed to take 1 total

tax percentage. If you state requires it

to be broke down into State, County, City, etc… you will add all percentages

together to equal a total percentage.

i.e., State

= 7.5% County = 1.5% and City = 1% you will collect the total of 10% sales tax.

Once a tax schedule is created it

cannot be deleted. However, the postal

code ranges with in the schedule can be deleted and recreated.

When

creating a sales tax schedule it is very important to set the time to 00:00:00

for the date the tax is changing. i.e.,

tax change takes effect January 1 2012.

The date time entered should be in the following format: 2012-01-01

00:00:00. Note: Once a schedule is

created it cannot be deleted.

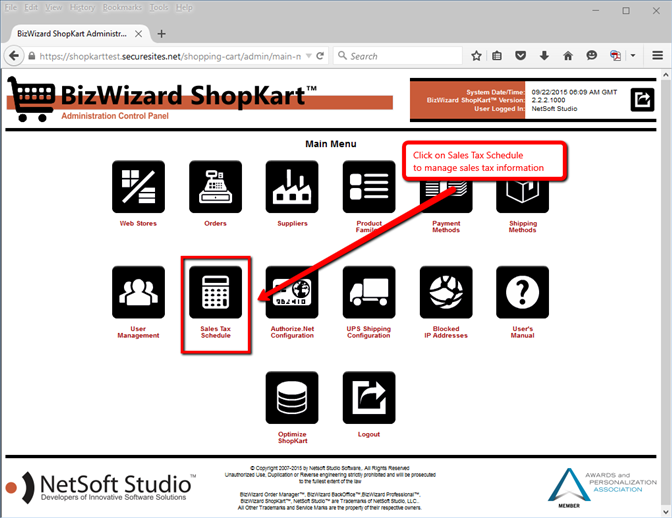

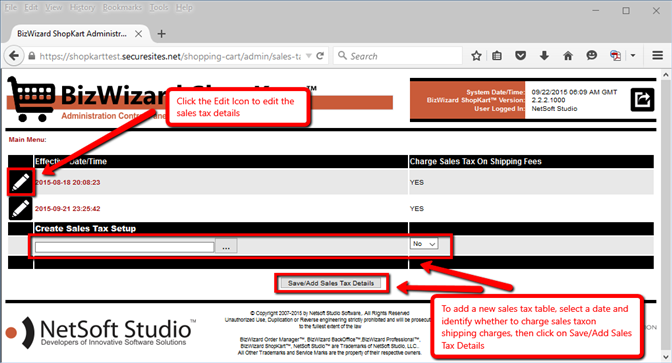

Step1:

Set

the date/time and selected Yes or No for Sales Tax on Shipping Fees. Then click

Save/add Button.

Step2:

Add

postal code range for your State, County, City, etc… Save/add Button. Click Main Menu when Finished.

When adding

postal code ranges start with the largest community, like the range for the

state. Set only the state tax. In most

states this will include all taxes. i.e., City is 1%... County is 1.5%... State is

7.5%... = 10%

However, if

your state requires your taxes to be separated; you will only include the state

portion. i.e., State is 7.5%... =

7.5%

Next add

postal codes range for the county excluding the rest of the state. Now, include all taxes for county and State. i.e., County is 1.5%... State is 7.5%... = 9%

Next add

postal codes range for the City excluding the rest of the state. This time

include all tax levels. i.e., City is

1%... County is 1.5%... State is 7.5%... = 10%

Important reminder: If the same postal code is in 2

ranges the range created last will override the earlier range.