|

The Financial posting summarization provides necessary figures and totals to post journal entries into accounting software (such as QuickBooks®, Peachtree®, MYOB®, or other accounting program) – There are basically five figures you need to post into your accounting program as journal entries, typically once a month, once a week, or once a day, whichever works for your company. Many trophy shops simply do this once a month when they close out their accounting financials for the month. |

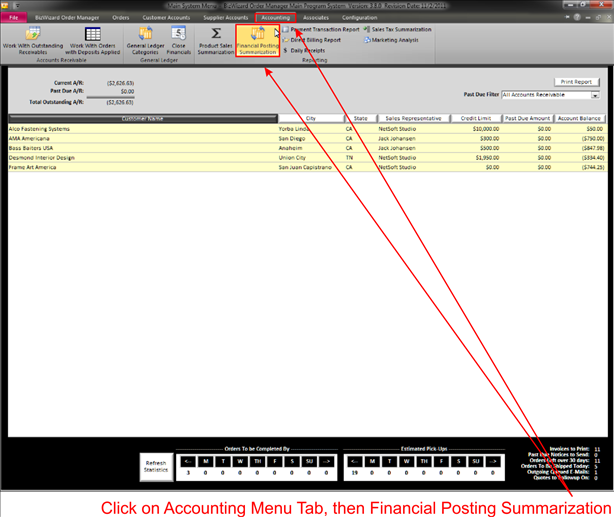

Click on the Accounting Menu, then Financial Posting Summarization as show below:

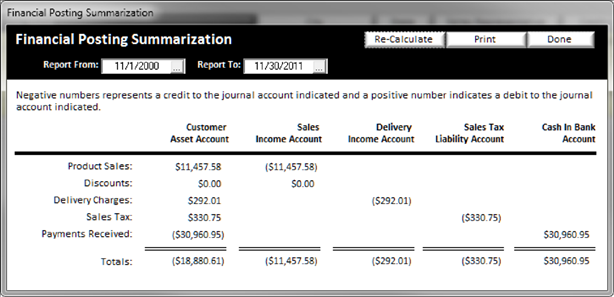

You will be presented with the following screen:

There are basically 5 totals that need to be posted as journal entries as shown above and described below:

v Product Sales

Should post to the Journal Account that is your customer asset account. The actual name of the customer asset account will vary depending upon how you setup your accounts in your accounting program. After you have posted the totals from the customer asset account, a reversing entry for that same amount needs to be posted to your sales income account, again the actual name of your sales income account will vary depending upon how you setup your accounts with your accounting program

v

Discounts:

Should post to your Customer Asset Account and the reversing entry to your Sales Income Account

v

Delivery

Charges:

Should post to your Customer Asset Account and a reversing entry to your Delivery Income Account

v

Sales

Tax:

Should post to your Customer Asset Account and a reversing entry to your Sales Tax Liability Account

v

Payments

Received:

Should post to your Customer Asset Account and a reversing entry to your Cash in Bank Account

You can change the date range the figures are reporting on at the top and then click on Re-Calculate to obtain the new totals. You may also print a copy of this screen if you wish to obtain a hard copy. It is recommended that before you post any amounts to your accounting program that you close your Accounting Month using Close Accounting Financials