Sales Tax Summarization Report

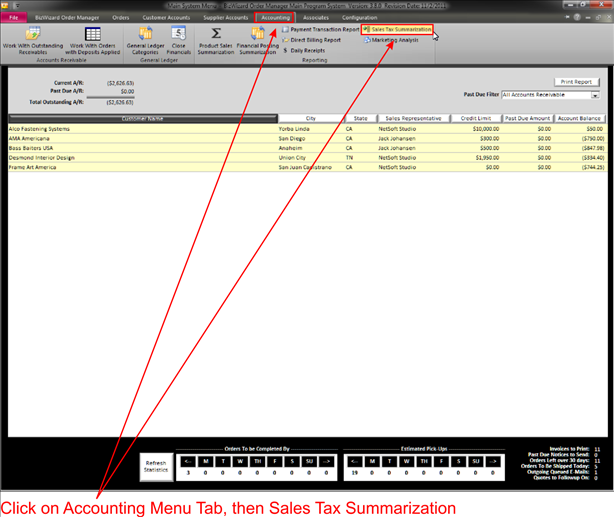

To process a Sales Tax Report, click on the Accounting Menu System and then Click on the Sales Tax Summarization Icon as shown below:

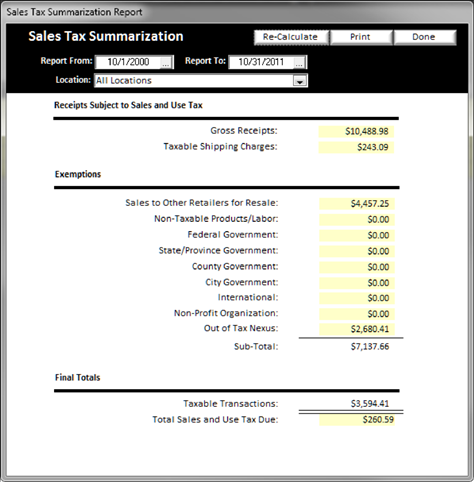

This will open the following window:

On this screen select the dates needed to run a report and for which location. If there is only one location simply leave the default of All Locations Selected. When ready, click on the Re-Calculate button to process the data.

The numbers for the different Exemptions will be figured based on the Sales Tax information set up during sales tax setup configuration (See Sales Tax Setup and also see Getting Started in 3 Simple Steps) and based upon what exemptions were chosen on each order (See Sales Tax Exemption).

If you need to see where a Dollar amount came from in any of the categories, double click on any Yellow Background Text Fields (See Understanding Yellow Background Fields) to view more detailed information for each invoice line item that comprises the total.

NOTE: It is important to understand that actual

sales tax collected and the sales tax liability figure on the sales tax

summarization report may differ. This is

normal and here is why.

When

an order is taken, the sales tax on that “INDIVIDUAL” order is calculated and rounded to the nearest penny. When there are hundreds or even thousands of

orders in a single month, each with a rounding that has occurred for each

order, the total amount collected for sales tax will be different.

This

report takes the total sales for the entire time period and rounds the total one

time. So if you have let’s say 500

orders that each individually had a rounding so you collected the sales tax 500

times for each individual order, you will have a different amount collected vs.

a different amount report.

You sales tax board is aware of that what you collect in sales tax will be different than what is reported. Specifically, your sales tax board wants to know what your total sales were (total all the product sales for each order), then multiply the total sales by the tax rates appropriate and round only one time.

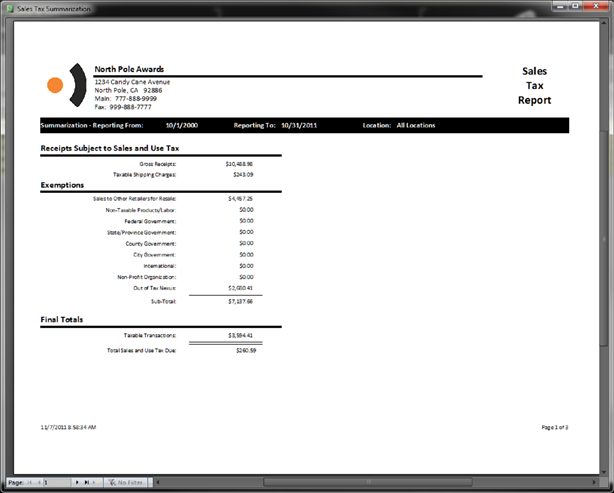

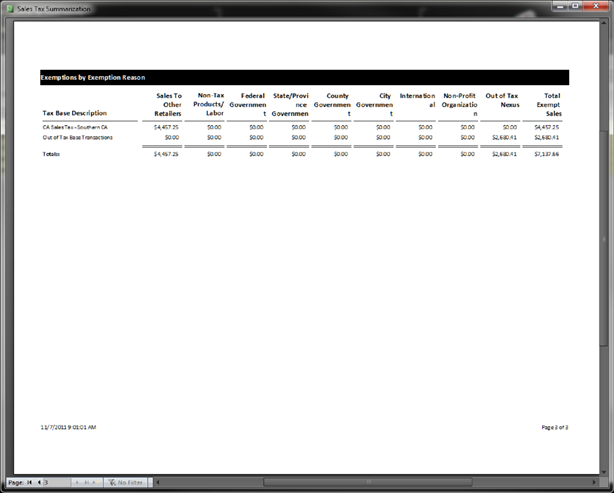

The following is an example of this report printout. There are 3 pages in the following example showing the sales tax information broken down in 3 different analysis formats:

The first page of the sales tax summarization is a printout of the totals that were shown on your computer screen as shown above

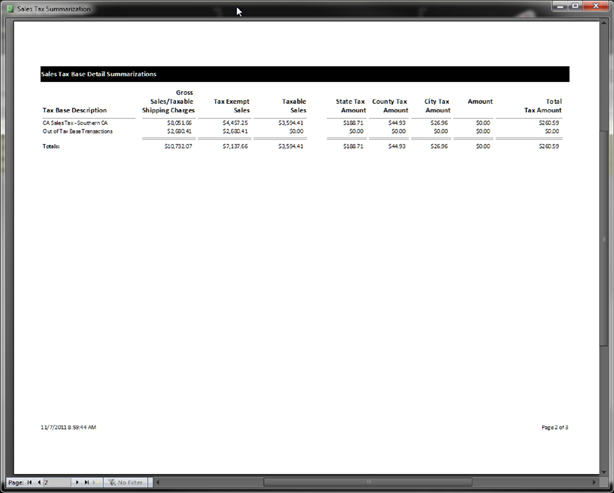

The above screen shows a breakdown of sales tax by your sales tax nexus that has been configured when your sales tax tables were setup as well as the breakdown by state, county and city if you have setup your sales tax tables to break these percentages down into those categorizations

The above screen shot of the third section of the sales tax summarization printout shows a breakdown of sales tax nexus with figures broken out into exemption reasons