|

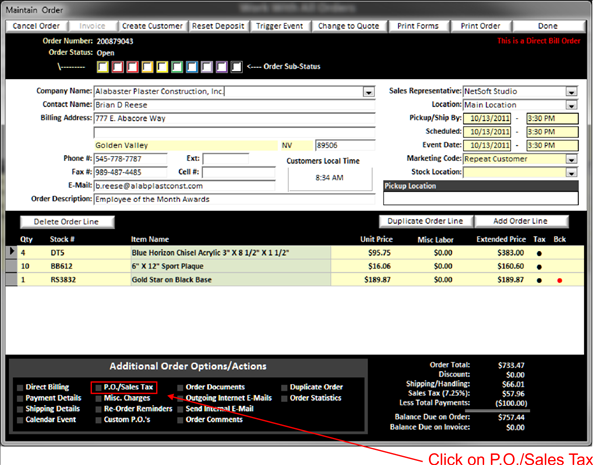

To make an order exempt from charging Sales Tax, click on the P.O./Sales Tax to select the Sales Tax Exemption reason. |

|

|

|

|

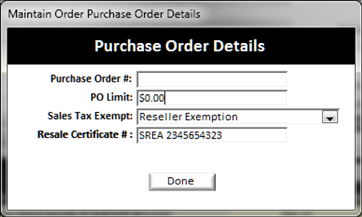

When you click on the P.O./Sales Tax text the Purchase Order details window will pop up:

|

|

On this screen you can select the reason for the Sales Tax exemption. There are various agencies or organizations that are not required to pay a state sales tax.

When an order is exempted from sales tax, the line items exempted will report on the sales tax summarization as exempted. Sales tax exemption reasons may be configured in System Setup.

NOTE:

Check with your CPA, Accountant or state agency to ensure that you are

collecting Sales Tax from all

customers that are required to pay. Do not assume that if a customer tells you

they don’t have to pay that they are correct. We also recommend you collect a Sales

Tax Exemption request for each order that you exempt as a protection for

why sales tax was not collected. This

documentation can come in handy during a sales tax audit.