Sales Tax Setup

You cannot delete Sales Tax tables, as they must remain for historical purposes for the order history, however you can use a Sales Tax table that you previously created as a template for a new Sales Tax table with a new effective date and time. The following is the Sales Tax tab as show in the General System Setup.

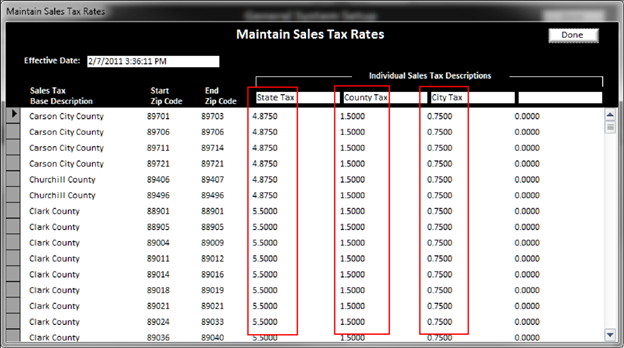

The section to the left is where you can manage the Sales Tax table itself. This is a table that is utilized by the orders shipping and delivery postal code (See Ship-To Address) to determine the point of delivery and thus what Sales Tax percentage should be charged. See the next example:

As you can see from this example, we have setup different tax rates for different postal code ranges. The orders shipping address postal code/delivery postal code will use this table to lookup a matching entry. For instance, if the postal code being shipped to is 89015, then starting at the top in this list, order manager will see which row that postal code fits into. In this case, it fits into Clark County with a Sales Tax rate of 7.75%. Thus the Sales Tax rate that will be used on the order will be 7.75%

It is important to ensure there are not any duplications or postal code ranges. For instance having two rows whereby the same postal code fits into those rows can cause unexpected behavior. Simply ensure that the postal code ranges are unique.

The effective date and time is compared against the order entry date (See Order Statistics) and time to determine which Sales Tax table to use for sales tax calculation. If your state sends you new Sales Tax setups that are to go into effect 4 months from today, you can enter those new Sales Tax records today, and set the effective date and time appropriate to the effective date the records should begin being used.

Once that date and time passes, BizWizard Order Manager™ will automatically start using the new Sales Tax records.

Across the top, there are 4 columns. Each of these columns allows you to breakdown the Sales Tax records into individual components such as the state portion, county portion, city portion. See the following example:

In the above scenario, for postal code 89015, the total Sales Tax charged on an order will be 5.5% + 1.5% + .75% for a total Sales Tax charged on the order of 7.75%. The reason we split this out into state, county and city is some Sales Tax filing reports require you to split the figures out. If you split it out here in the Sales Tax setup, then it will also split out when you run your end of month Sales Tax report (See Sales Tax Summarization Report). However, the customer will still see 7.75% as the Sales Tax rate on their receipt. It will not be split out in the customers receipt view.

As to whether you split the Sales Tax out into state, county and city really depends upon whether you need this information split out on your reports. As to whether you split out into different postal codes for different counties also depends upon your state filing requirements. Some states require it to be split, some do not. Check with your accountant or state agency to determine the requirements that are applicable to your business.

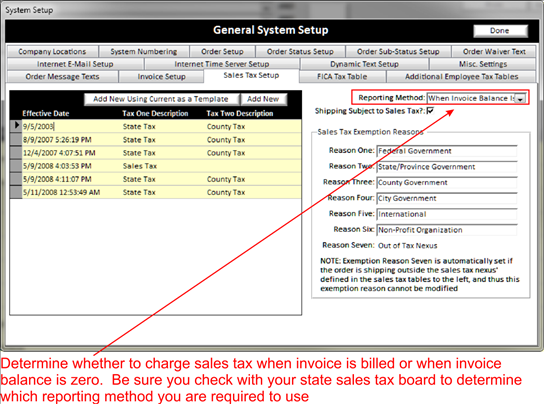

When you report Sales Tax to the state is different from state to state. Some states want you to report the Sales Tax when the sale completes, even if the order is invoiced and you have not collected payment yet. Other states do not require you to report the sales until you actually receive payment on the sale. Consult the filing requirements of your state to ensure you are in compliance with your state laws.

The pull-down list here allows you to define to BizWizard Order Manager™ when the sale is to be reported on your Sales Tax summarization (See Sales Tax Summarization Report) each month. Whether to report the sale once you receive payment or to report it when the order is invoiced even if the invoice has not been paid. Simply select the pull-down option that fits into your states filing requirements.

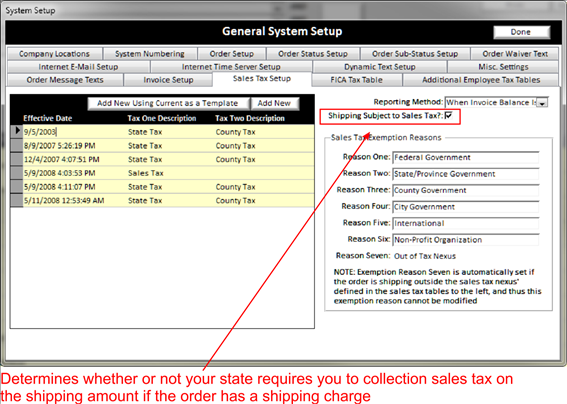

As to whether your state requires collection of Sales Tax on the shipping portion of the order is something you should check into for your states rules concerning shipping charges. Some states require that you charge Sales Tax on the shipping charges, some do not. If your state requires you to charge Sales Tax on shipping charges, be sure you checkmark this box and BizWizard Order Manager™ will include the shipping charges as part of the total for Sales Tax calculation.

BizWizard Order Manager™ supports up to 6 customizable Sales Tax Exemption Reasons. Reason number seven is reserved for out of Sales Tax nexus (which means the orders shipping postal code(See Ship-To Address) falls outside the Sales Tax zones for which you are required to collect Sales Tax, typically this is out of state transactions)

Unless you require customization of the default options already set, leave these values alone. Otherwise, feel free to customize the text by changing them here. All six reasons must have a value specified, even if it is not used.